CHEAH CAPITAL

About Us

WHO WE ARE

Value investing always outperforms in the long run.

To me, the core definition of value investing has never changed. But we must adapt and evolve.

Never stop learning, be honest and have integrity in everything you do

Your reputation is your brand, so take good care of it.

Founded in 2010, Cheah Capital is a fully-owned private company and single-family office dedicated towards the sole stewardship and preservation of the family’s assets.

The Cheah Family Office is based in Hong Kong, the financial hub of Asia, and in 2021 the family office has successfully expanded into Singapore. Owing to our owner’s Malaysian roots, we also have a presence throughout Malaysia – primarily in Penang and Kuala Lumpur. While its expertise lies in the Greater China region, the family’s investments are diversified across all asset classes and industries throughout the globe.

Cheah Capital’s founder, Cheah Cheng Hye is the co-founder of asset management firm Value Partners Group, the only listed asset management firm in Hong Kong. Value Partners is also the recipient of numerous prestigious performance awards.

For over two decades, Value Partners has practiced disciplined value investing and being a contrarian rather than following the herd.

The same investment philosophy and life principles are deeply embedded in the family office's culture and values.

Lifelong learning, discipline and integrity – these are the guiding principles which Cheah Capital operates on.

To grow itself into an institutionalized platform to serve both the professional and personal needs of the Cheah family, Cheah Capital maintains a balanced goal of capital preservation and wealth creation with the support of a group of tightly-knitted and well-trained individuals.

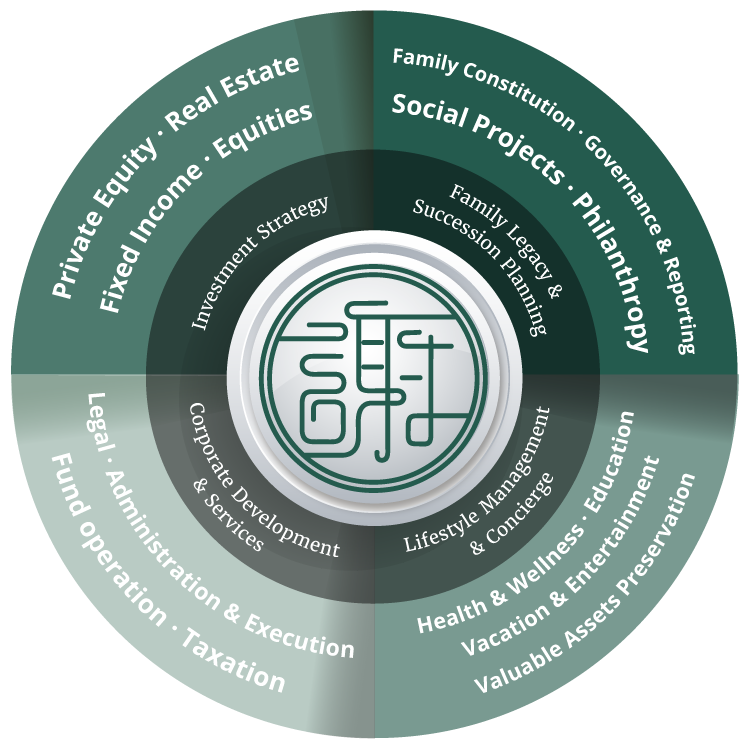

OUR BUSINESS

Philosophy

The family office’s investment philosophy is deeply tied to value investing. We embrace our founders’ value-based approach in our analysis of investments and opportunities, while adapting the evolution of value investing into “quality” value investing that enables us to capture high growth potentials.

We conduct ourselves with a culture of transparency and productivity, with honesty and discipline guiding our every action.

This practice lends weight to our commitment to provide excellence, with kindness overlaying every action.

A huge tenet of our founder’s work ethic has been to always put the client’s needs before ours.

OUR BUSINESS

Strategy and Objectives

INDUSTRY AND GEOGRAPHICAL PREFERENCES

Generally, the Cheah family office adopts an agnostic view towards an investment’s industry and geographical traits. We select appropriate investments based on the family’s short-term and long-term needs, while resisting trends and methods that are not time-tested.

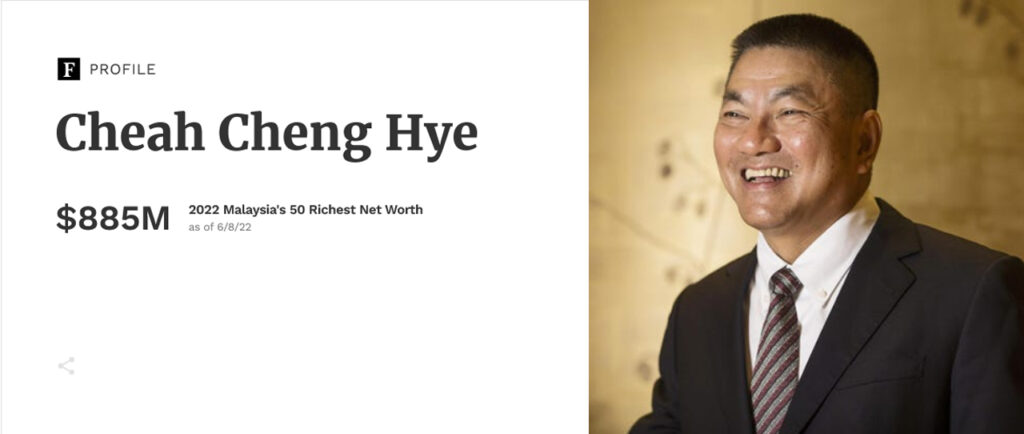

ABOUT

THE FOUNDER

Meet Cheah Cheng Hye, a pioneer in value investing in Asia-Pacific markets and a thought leader on finance, markets and other subjects, who needs knowledge the same way a car needs fuel. Until today, he strives to learn everything he can.

The story of this man and Value Partners is inseparable, a firm started as a “hobby shop” in 1993 now finds itself in the league of top asset managers in Asia.

While he may run a fund size of a few billions, Cheah started out as a journalist in the backroom of a newspaper company in Penang, Malaysia back in the 60s.

His natural instinct, hunger for knowledge and curiosity for people and stocks enabled him to monetise ideas and create one of Asia’s largest fund management firms. Cheah’s street smarts and ability to sniff out stocks before they turned to winners perhaps came from his humble beginnings.

In 1993, armed with the knowledge, insights and experience of investing in small and mid-cap stocks, Cheah took the bold step of founding Value Partners with his partner V-Nee Yeh with less than US$5million worth of assets under management. The Company was listed on the Hong Kong Stock Exchange in 2007.

Today, Value Partners is one of Hong Kong’s biggest success stories.

For those who want a fraction of Cheah’s success, he believes in practising disciplined value investing and contrarian thinking. He thinks that honesty far outweighs the ability of any person or company to make money. “My name is my brand”, Cheah said.

This stellar performance is not surprising considering investing runs deep in Cheah’s blood.

It is a known fact that Cheah is passionate about investing. To him, it is an art, not a pure science.

A successful investor should have the ‘killer instinct’, while at the same time always being honest and having integrity. Any shred of ego needs to go out the door.

While honesty may not be a requirement to pass any investment exam, it is this quality that makes the difference in delivering sustainable outperformance.

Join Our Team

If you’re someone who is a highly-skilled problem solver and relishes new challenges, we’d love to hear from you. Please drop us a note at [email protected]